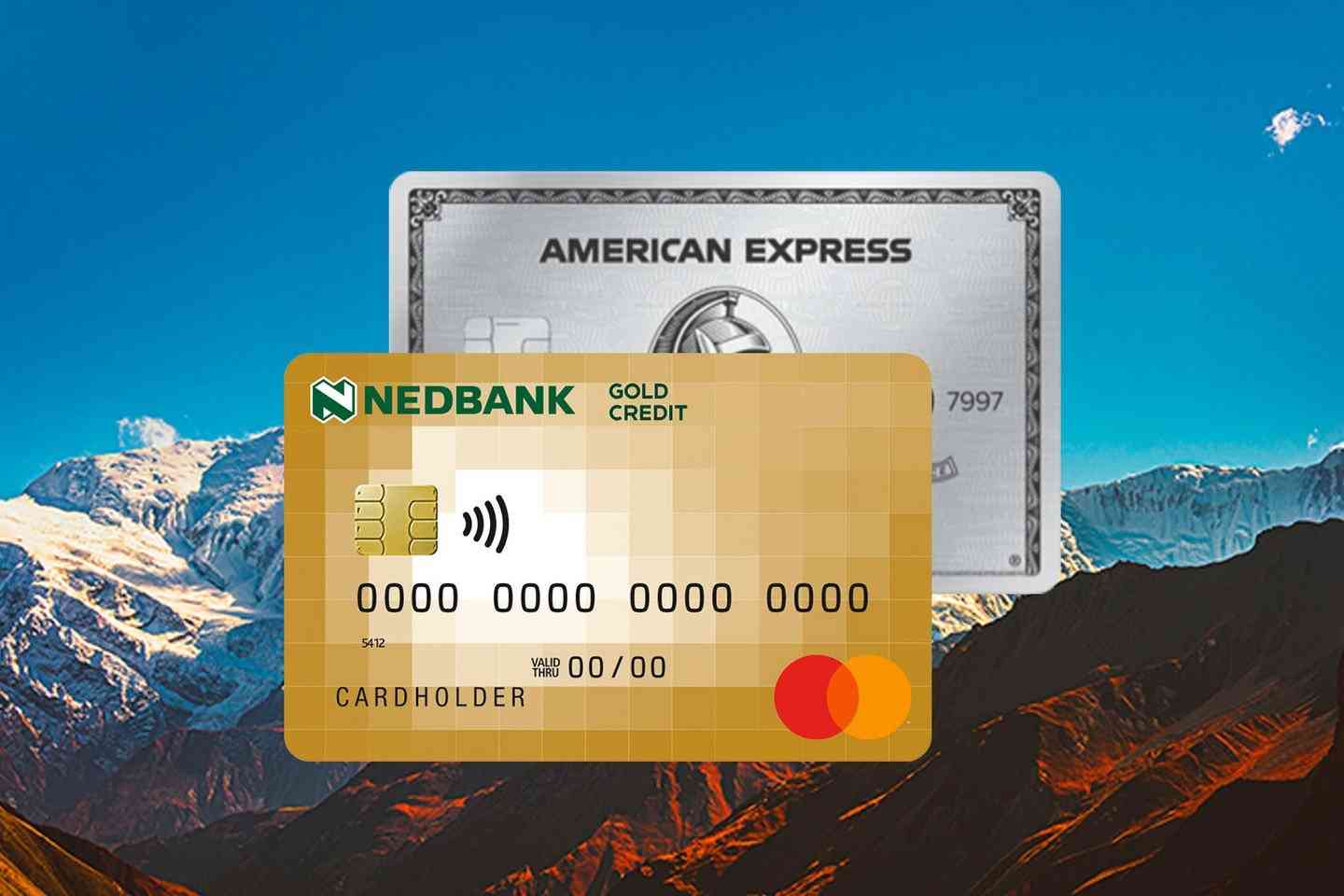

NEDBANK Zimbabwe’s partnership with American Express saw a 226% increase in the volume of transactions by international cardholders using their platforms last year, it has been revealed.

American Express is globally integrated payments company.

The partnership was first announced in August 2023, and allows Nedbank Zimbabwe to acquire merchants, enabling international American Express card members to use their cards in Zimbabwe.

“In August 2023 we launched American Express acquiring services in Zimbabwe, adding to Mastercard and Visa and further enhancing our international card payments programme access for websites, e-commerce, point of sale and automatic telling machines in the country,” Nedbank Zimbabwe managing director Sibongile Moyo said, in a statement accompanying the bank’s financial results for the year ended December 31, 2023.

“Since we introduced American Express, we have witnessed a 226% increase in volume of transactions by international cardholders using our e-commerce and other channels at various merchants including airlines and tourist operators.”

The American Express usage contributed to a 221% increase in the bank’s fees and commission income to ZWL$173,38 billion in its financial year ended December 31, 2023, compared to the comparative year.

Moyo said over the period, the bank had also enabled interoperability on its mobile banking, point of sale and automated teller machine channels to accept US dollar payments and Zimswitch-enabled cards, opening its for use in US$ by customers of all banks in the market.

“The percentage of digitally active clients on our books grew to 67% by the end of 2023,” she said.

- Feli Nandi for Zimind, Nedbank listed companies awards ceremony

- Delta shines as headwinds torment ZSE firms

- Nedbank Zim heads for VFEX

- Editors Memo: Merry Christmas and a big thank you!

Keep Reading

During the period under review, non-funded income from client transactions, excluding unrealised foreign exchange gains, grew by 191%.

This was due to an increased number of active accounts, increased volumes of international payments and on the bank’s digital platforms, internet banking and ATMs.

“The overall increase of 251% recorded on non-funded income included unrealised foreign exchange gains of ZWL$502,925 billion arising from the revaluation of the Bank’s foreign currency net open position as the ZWL further depreciated against the US$ over the period,” Moyo said.

She said that the bank endeavoured to put client experience at the centre of enhancements to its business processes and touch points.

“In line with our commitment, we embarked on the journey to implement robotic process automation utilising software robots to automate repetitive, manual and rule-based tasks, to streamline key processes,” Moyo said.

The robotic process automation solutions had enhanced operational efficiency and client two-way interaction with the bank and responsiveness, she said.